how to avoid tax on 457 withdrawal

5 457b Distribution Request form 1 Page 3 Federal tax law requires that most distributions from governmental 457b plans that are not directly rolled over to an IRA or other eligible retirement plan be subject to federal income tax withholding at the rate of 20. Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation.

Can You Withdraw From Retirement Accounts For Education Disabilities Health Care Financial Planning Retirement Accounts Retirement College Expenses

They do not come with early withdrawal penalties if you leave your job.

. In some instances there may be after-tax funds in an individuals 401k. You can avoid paying taxes on your CARES Act retirement withdrawal if you are able to put the money back in the account within three years of the distribution. This is a very important rule that often times goes overlooked with the 457 plan.

When it comes to withdrawals 457b plans have a big advantage over 403bs and 401ks. As with a 401k plan you can get a tax deduction on money you contribute to a 457b plan and your earnings grow on a tax-deferred basis. To confirm this contact your plan administrator.

Here is a list of the key rules. Unlike other retirement plans under the IRC 457. If you withdraw money from your traditional IRA before age 59 12 theres a 10 early withdrawal penalty and that is in addition to the income tax.

Withdrawals from Roth IRA and 401 k. So if you need to tap into your 457b contributions before you reach age 595 and youve left the job that provided you with the 457b don. If you have a 457 plan and you die your beneficiary can take distributions from the plan immediately.

Choosing to use a hardship withdrawal in a time of need comes with an assortment of long-lasting negative tax implications that can be avoided by selecting one of the options above. A 457 b plan is a retirement account for employees of state and local governments and agencies. IRC 457 Early Withdrawal.

Use this calculator to see what your net withdrawal would be after taxes are taken into account. Withdrawal Rules for a 457b Account. All distributions from IRAs 401 ks 403 bs and 457 accounts are subject to income taxes at ordinary income tax rates except Roth accounts assuming all requirements are met and any funds contributed on an after-tax basis.

457b Withdrawals On the one hand unlike most other tax-advantaged retirement plans you may be able to withdraw funds in your 457b account penalty-free before you reach age 59 ½. There is no penalty for an early withdrawal but be prepared to pay income tax on any money you withdraw from a. Withdrawals from a 457b plan are highly regulated so you may not be able to access the.

The CARES Act signed into law last March by then-President Donald Trump allowed individuals to withdraw up to 100000 from their retirement account without paying the usual 10 tax penalty if. A 457b plan is a tax-advantaged retirement plan restricted to state and local public governments and qualifying tax-exempt institutions. This however only applies when you leave your employer and you still must pay applicable income taxes on anything you withdraw.

Beneficiary distributions avoid the early withdrawal penalty of 10 percent regardless of the age of the beneficiaryHowever distributions are still taxed as ordinary incomeBeneficiaries can avoid taxation by rolling over the 457 distribution to a qualified. Money saved in a 457 plan is designed for retirement but unlike 401k and 403b plans you can take a withdrawal from the 457 without penalty before you are 59 and a half years old. If you have a governmental or non-governmental 457 b plan you can withdraw some or all of your funds upon retirement even if you are not yet 59½ years old.

How do I avoid taxes on deferred compensation. Of course you can avoid that penalty by withdrawing money earlier starting at age 59 ½. By rolling into the IRA you lose the ability to cash out early to avoid the penalty in case you need access to your funds.

IRA withdrawals before age 59 ½ will incur a 10 penalty in addition to any taxes owed. You can take money out of your 457 plan without penalty at any age although you will have to pay income taxes on any money you withdraw. Tax-exempt 501 c organizations such as charities and.

Theres some good news for those participating in a 457 plan. Notice I said former. Information and interactive calculators are made available to you only as self-help tools for your independent use and are not intended.

How Withdrawals Work. Unlike other retirement plans under the IRC 457 participants can withdraw funds before the age of 59½ as long as you either leave your employer or have a qualifying hardship. How much tax do you pay on a 457 withdrawal.

There are legal strategies you can use to at least minimize the taxes you pay on your individual retirement account IRA contributions but it may be a good idea to speak with a financial advisor before going all in on any one strategy. The same penalties apply to withdrawals from employer-sponsored 401k plans too. Tax advisors are constantly searching for new ways to avoid paying taxes on IRA withdrawals.

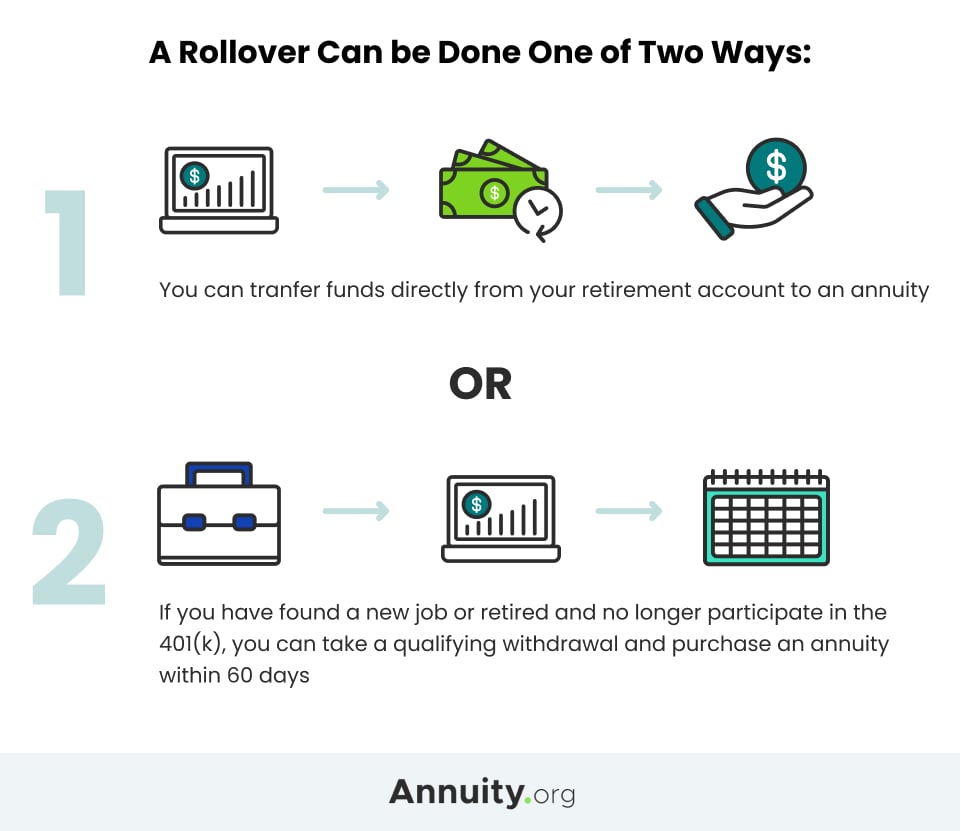

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

How A 457 Plan Works After Retirement

5 Tax Savvy Retirement Withdrawal Strategies Apprise Wealth Management

How Can I Get My 401 K Money Without Paying Taxes

Annuity Withdrawals Everything You Need To Know 2022

New Single Distribution Rules Effective 01 01 2015 Investing For Retirement How To Plan 401k Plan

Tax Free Withdrawal Of Us Based Retirement Funds Sf Tax Counsel

457 Deferred Compensation Plan Video In 2022 How To Plan Retirement Planning Deferred Compensation

A Guide To 457 B Retirement Plans Smartasset

Should You Pay Off Your Home With Retirement Funds Pros And Cons

Spending In Retirement Withdrawal Strategies And Tax Tips Principal

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

How Cares Act Eases Retirement Account Rules Forbes Advisor

How 401 K Tax On Withdrawals Can Hurt Your Finances Credit Karma Tax

Best Student Credit Cards For February 2022 Travel Rewards Credit Cards Credit Education Student Rewards

Coronavirus Financial Hardship Withdrawal From 401 K Plans

A Guide To 457 B Retirement Plans Smartasset

Put Simply 72t Is An Internal Revenue Service Irs Rule That Allows For Penalty Free Early Withdrawal Individual Retirement Account Irs Retirement Accounts